Learning about investing for the first time means facing a steep learning curve. When dealing with new terminology, negotiating your way through a foreign language is an extra challenge. Of course, we can find books and info online in English. However, opening an investment account in Korea means dealing with a lot of not-basic Korean language.

To help myself (and anyone who might read this) get familiar with potentially relevant information in the Mirae Assets app, I’m going to write out and translate some of it here.

Being a foreign citizen in Korea, I haven’t found a way to buy American stocks through a local account. At the two investment banks I’ve applied to (Mirae Assets and Hangook Tooja), I’m restricted to buying local financial products, though that includes ETFs that track the American market.

I’ll break down some of the information that appears under the ETF정보 tab for Tiger 미국S&P500 ETF.

Tiger 미국S&P500

06.05 종가 KRW ... date and closing price in KRW

52주 최고/최저 KRW ... 52 week high/low in KRW

Below the image it says:

ETF 유형 ... Type of ETF 주식형 | 북아메리카 ... Stock type | North America

경쟁 ETF ... Competing ETFs A133690, A360200, A379800, A367380

거래 정보 / Transaction Information

| 5일 평균 거래량 (주) ... Average 5-day volume (shares) | 985,886 |

| 20일 평균 거래량 (주) ... Average 20-day volume (shares) | 865,912 |

| 5일 평균 거래대금 KRW 억 원 ... Average 5-day transaction price (KRW 100 millions) | 137.15 |

| 20일 평균 거래대금 KRW 억 원 ... Average 20-day transaction price (KRW 100 millions) | 119.71 |

| 시가총액 KRW 조 원 ... Market capitalization (KRW trillions) | 1.85 |

기준: 2023.06.05 ... Until 2023.06.05 (This kind of thing appears a few times to let you know how recent the data is)

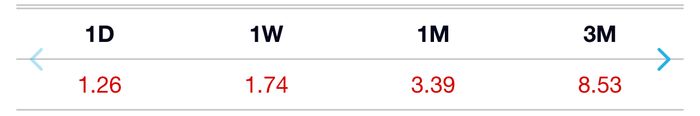

수익률% / Rate of return%

You can select PRICE or NAV (Net Asset Value) and scroll to the right.

*Price는 수정주가 기준 수익률, NAV는 NAV 기준 토탈리턴 수익률 ... *Price has a revised price-based return, NAV's Return On Total Return Based On NAV

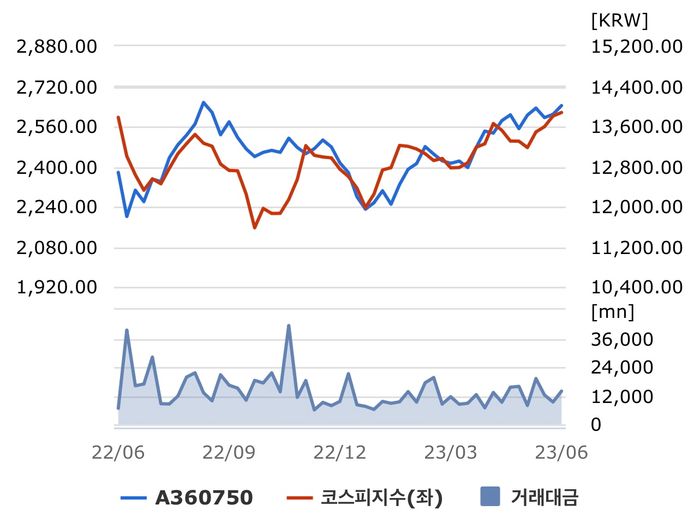

시장지수 대비 주가 비교 % / Stock Price Comparison Against Market Index %

A360750

코스피지수(좌) / KOSPI index (left)

거래대금 / Transaction Price

*ETF는 수정주가 기준, 시장지수는 ETF 상장국가의 대표 지수 선정 ... *ETF is based on revised stock prices, market index is selected as representative index of ETF-listed countries

개요 / Outline

국문 ... Korean language

이 ETF는 미국 주식을 주된 투자대상자산으로 하며, “S&P500 지수”를 기초지수로 하여 1좌당 순자산가치의 변동률을 기초지수의 변동률과 유사하도록 투자신탁재산을 운용함을 목적으로 합니다. “S&P500 지수”는 S&P Dow Jones Indices에서 발표하는 지수로서, 미국에 상장된 종목 중 시가 총액 상위 500 종목을 편입시키는 미국 대형주 시장대표 지수입니다.

The ETF aims to operate investment trust properties with U.S. stocks as the main investment target and the "S&P 500 Index" as the underlying index, so that the rate of change in net asset value per account is similar to the rate of change in the underlying index. The "S&P 500 Index" is an index released by S&P Dow Jones Indices, a U.S. large-cap market leader that incorporates the top 500 stocks in market capitalization among U.S.-listed stocks.

기본 정보 / Basic Information

| 기초지수 ... Basic Index | S&P 500 Index |

| 대분류 ... Large category | 주식형 ... Stock type |

| 중분류 ... Middle category | 북아메리카 ... North America |

| 설정일/통화 ... Set up date / Currency | 2020.08.06 / KRW |

| NAV KRW ... Net Asset Value KRW | 14,036.71 |

| 괴리율% ... Disparity rate% | -0.150 |

| 추적오차 ... Tracking error | 6.0600 |

| 레버리지 배율 (배) ... Leveraged scaling | |

| 연 평균 분배율% ... Average annual distribution rate% | 1.25 |

| 보수율% ... Expense ratio | 0.14 |

*Distribution rate (분배율) is similar to a dividend rate. With standard stocks, as opposed to ETFs, 'dividend rate' is expressed as 배당률.

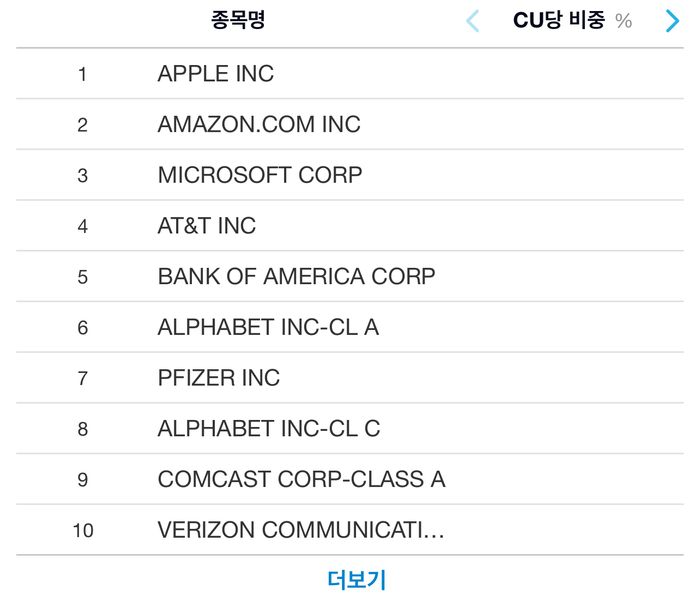

포트폴리오 Top 25 / Portfolio Top 25

You can select FnGuide or Morningstar and see the top 25 companies in the ETF.

더보기 ... See more

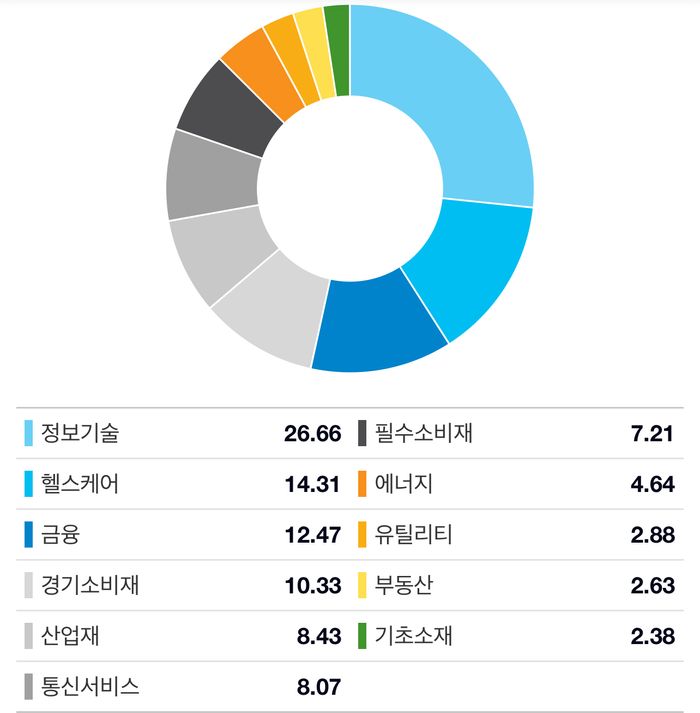

섹터별 분포% / Distribution % by Sector

정보기술 Information Technology

헬스케어 Health Care

금융 Financials

경기소비재 Consumer Discretionary

산업재 Industrials

통신서비스 Communication Services

필수소비재 Consumer Staples

에너지 Energy

유틸리티 Utilities

부동산 Real Estate

기초소재 Materials

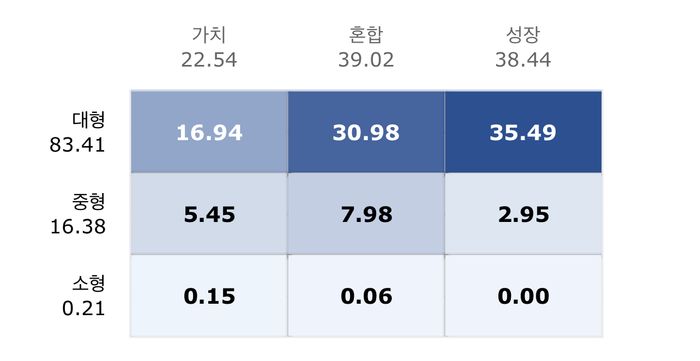

규모/스타일별 분포% / Distribution % by Size/Style

Down the side: 대형 ... Large, 중형 ... Medium, 소형 ... Small

Across the top: 가치 ... Value, 혼합 ... Mix, 성장 ... Growth

주요 투자 국가% / Major Investment Countries %

| 국가 ... Country | 비중% ... Percentage |

|---|---|

| 미국 ... United States | 93.18 |

| 한국 ... Korea | 5.80 |

| 영국 ... United Kingdom | 0.54 |

| 스위스 ... Switzerland | 0.31 |

| 네덜란드 ... Netherlands | 0.13 |

| 싱가폴 ... Singapore | 0.03 |

ETF 비교분석 / Comparative Analysis of ETFs

You can select 글로벌/한국 ... Global/Korea and the currency, and select the ETF you want to compare this one with. Below, I only include the infomation for this ETF. Quite a bit of the information is repeated here from above.

| 대분류 ... Large category | 주식 ... Stock |

| 중분류 ... Middle category | 북아메리카 ... North America |

| 상장국가 ... Listed Country | 한국 ... Korea |

| 전일 종가 ... Previous day closing price | 14,015 KRW |

| 시가총액 mn ... Market capitalization (millions) | 1,412.96 |

| 순자산 mn ... Net assets (millions) | 1,384.77 |

| 기초지수 ... Basic index | S&P 500 Index |

| 레버리지 배 ... Leverage (times) | |

| 분배 유형 ... Type of distribution | 지급 ... Provision |

| 분배율% ... Distribution % | 1.25 |

| 보수율% ... Expense ratio | 0.14 |

The next table, 수익률 ... Rate of Return, contains no Korean.

| 샤프지수 ... Sharp index | 0.42 |

| 표준편차% ... Standard deviation | 17.70 |

| PER 배 ... Price to Earnings Ratio | 18.62 |

| PBR 배 ... Price to Book-value Ratio | 3.42 |

| ROE % ... Return on Equity | 29.79 |

| ROA % ... Return on Assets | 10.92 |

| Morningstar rating | N/A |

| 주식% ... Stock | 99.88 |

| 채권% ... Bond | 7.31 |

| 현금% ... Cash | -11.10 |

| 기타% ... Others | 3.91 |

※ 기본 비교대상 ETF는 현재 조회 중인 ETF의 상장국가, 유형, 규모(대중소)와의 유사성을 고려하여 표시함 ... ※ The basic comparable ETF is displayed in consideration of similarities to the listed country, type, and size (large and small) of the ETF currently being inquired.

※ 본 서비스는 모닝스타 데이터를 바탕으로 11개 상장국(미국, 일본, 중국, 대만, 홍콩, 싱가포르, 인도네시아, 태국, 인도, 베트남, 한국)에 대해 제공되며, 모닝스타 정책에 따라 상장국가별, ETF별, 데이터 항목별 업데이트 주기가 상이할 수 있습니다 ... ※ Based on Morningstar data, this service is provided to 11 listed countries (US, Japan, China, Taiwan, Hong Kong, Singapore, Indonesia, Thailand, India, Vietnam, and Korea), and the update cycle by listed country, ETF, and data item may vary depending on Morningstar policy.

※ 환율 변환은 조회 당일 최초고시환율을 적용하며, 기본 통화가 아닌 다른 통화로의 환산값은 투자자들의 편의를 위한 참고용 정보입니다 ... ※ The exchange rate conversion applies the first notified exchange rate on the day of the inquiry, and the conversion value to a currency other than the basic currency is for investor convenience.

※ ETFGlobal 서비스 대상 11개 국가의 전체 ETF를 기준으로 상위 60%를 Large Cap, 차상위 24%를 Mid Cap, 하위 16%를 Small Cap으로 분류합니다 ... ※ Based on the total ETFs in 11 countries targeted for ETF Global services, we classify the top 60% as Large Cap, the next 24% as Mid Cap, and the bottom 16% as Small Cap.

That’s a lot of information. It's too much, really. I also started an account with a New Zealand company (when I was in New Zealand), and they have a much better design. It's less cluttered, and they provide links to more information should you want it.

I think we can disregard some of the information above when making investment decisions, but I don’t know exactly which bits yet. I'll follow up this post with one focused on the most useful data points for a newbie and a comparison across several ETFs.